Lav Rente Refinansiering – When’s The Best Time to Refinance Your Mortgage

You might be wondering whether or not it’s still a smart time to refinance your mortgage loan given that interest rates are currently higher than they were a year ago. That’s a very good question, folks.

Your current mortgage loan will be paid off and replaced with a new loan once the refinancing process is complete. Refinancing your mortgage can provide you with a number of advantages, and lowering your interest rate is only one of them.

In addition, it is useful for homeowners who wish to get rid of their private mortgage insurance (PMI), modify the terms of their loan, or adjust any number of other things.

There are certain people who would be better off not refinancing. It all comes down to your own financial circumstances. If you think that getting a mortgage refinance will be beneficial to you, then the first thing you should do is answer some straightforward questions to determine how much money you could potentially save. You can discover more relevant info on this page.

Learn the ins and outs of mortgage refinancing so you can stay on top of the game.

When is the most advantageous time to get your mortgage refinanced?

We’re here to tell you folks that there’s no one-size-fits-all answer to the question of when you should refinance. It’s pretty much dependent on your goals, your budget, and your intentions as a homeowner.

Are you interested in lowering either your rate or your payment for good? Do you wish to make quicker progress toward repaying your loan?

Well, you might be able to accomplish both goals by refinancing your mortgage. Yay!

If you’re able to reduce your interest rate by at least one percentage point, the vast majority of financial experts agree that refinancing could be beneficial to you. When it comes to higher loan amounts, a difference of even a fraction of a percentage point can make a significant impact on the overall costs of the loan during its lifetime. In certain circumstances, it may be worthwhile to save a half point.

Calculating your breakeven point, also known as the month in which you will repay the money you spent on closing expenses, will help you decide whether or not it is worthwhile to refinance your home.

The payback period for a refinance of $5,000 would be about 33 months (5,000 / 150) if the monthly savings were $150. If you are planning to remain in the house for at least another 33 months, then it’s likely worth your money to refinance the mortgage.

If you are anticipating future costs that you would normally charge to a credit card, you should think about whether or not a cash-out refinance may be a better option for you.

Because the interest rates on mortgage loans, including refinances, are typically significantly lower than the interest rates on credit cards, this technique can typically save you money in the form of cheaper long-term interest costs.

Many homeowners roll their credit card and other revolving debts into a single loan payment by using the proceeds from a cash-out refinance, which is another common use of this financing option.

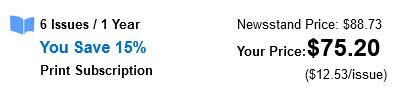

World Finance Magazine Subscription

If you decide to go through with the refinancing, the best time to do it is around the end of the month. Since you’ll only have to prepay interest for a few days, this will help you save money at closing.

You should also give some thought to the possibility of refinancing at the conclusion of a quarter when mortgage lenders might be trying to reach their quotas and might be willing to provide better terms in order to do so. A good idea is to take a look at this link refinansiere.net/lav-rente/ to learn more about your refinancing option folks!

When is it best to refrain from getting a mortgage refinance?

If you want to refinance your mortgage, it’s important to first determine whether or not you’d be a good candidate for such an option. In this scenario, timing is everything, and so is the current situation of your own money.

Refinancing a mortgage so soon after purchasing a house is typically not recommended. Two reasons contribute to this: certain lenders impose prepayment fees, and paying closing costs twice pushes down the time at which you break even. These essentially constitute a penalty for the fact that you paid off your mortgage debt ahead of schedule.

It’s possible that refinancing is not the best choice for you if you would be exchanging a low-interest rate for a rate that’s significantly higher. Increasing your interest rate may make sense in certain circumstances, but doing so will only result in a rise in your monthly expenses as well as an increase in the total amount of interest you will be charged over the course of the loan.

But, wait because that’s not all folks! If you have a bad credit score, you’ll probably decide against refinancing your mortgage. Your ability to save money by refinancing could be affected if you have low credit scores because higher interest rates are often associated with lower scores. In most cases, mortgage companies save the most favorable interest rates for clients whose credit scores are higher than 740.

A couple of things to consider before deciding to refinance

First of all, you should know that you’ll be pretty much responsible for paying all of the closing costs. It is estimated that each one costs roughly $5,000, but the precise sum may vary depending on the lender, the size of the loan, and the location of the borrower.

You can also choose to roll these costs into your loan and then pay them off over the course of the loan. If you choose this option, keep in mind that it will result in a larger loan amount, higher monthly payments, and higher interest costs over the course of the loan.

There’s a possibility that refinancing will badly affect your credit score, at least in the short term. This is due to the fact that your prospective lender will pull your credit report in order to evaluate your application. Your score will drop temporarily (often by no more than five points), as a result of this. If, on the other hand, you are able to make all of your payments on time, your credit score should improve rather quickly, folks.

Oh, and you should also know that in the event that a traditional mortgage refinance or a cash-out refinance doesn’t sound like something of use to you, a reverse mortgage is an additional option that should be taken into consideration.

A homeowner who is at least 62 years old and has either completely paid off their mortgage or has paid off the majority of it can use a reverse mortgage to access some of the equity in their house. The amount of tax-free income created by the release of previously taxed equity can be put toward the payment of debt, bills, or the completion of house repairs.

In the event that the homeowner passes away or decides to sell the property, the loan must be repaid in full. Before moving further with this option, be sure you have a complete understanding of its benefits and drawbacks. Do you know what you should do? Checking your eligibility for a reverse mortgage is a good first step if you’re considering getting one.

What else to know?

The interest rate on an adjustable-rate mortgage (ARM) may be lower than the interest rate on a fixed-rate mortgage at the outset, but it may grow to a higher rate over time. When this occurs, switching to a mortgage with a fixed interest rate results in a reduced interest rate and eliminates concerns about potential future increases in interest rates.

In contrast, if interest rates are falling, it may be financially prudent for homeowners who do not plan to remain in their houses for more than a few years to switch from a fixed-rate loan to an adjustable-rate mortgage, which typically has a lower monthly payment than its counterpart.

These homeowners have the option to lower their loan’s interest rate as well as their monthly payment; nevertheless, they won’t need to be concerned about how increasing rates would affect the loan in the next 30 years.

If interest rates continue to decline, the periodic rate modifications that come with an adjustable-rate mortgage will result in lower rates as well as reduced monthly mortgage payments, which will eliminate the need to renegotiate the loan every time interest rates decline. On the other hand, pursuing this course of action when there is an increase in the interest rate on mortgages is not a very wise choice.

Conclusion

There you have it folks! We hope we’ve provided you the information you need to make an informed decision about refinancing. There’s no need to rush thing because this is how typically mistakes get made and people end up regretting their decision. So, take the time to think things through!